IDTechEx estimates total demand for Li-ion batteries to have been over 200 GWh in 2019 and forecast Li-ion demand for plug-in electric cars alone to be nearly 350 GWh by 2025, but can supply meet this demand?

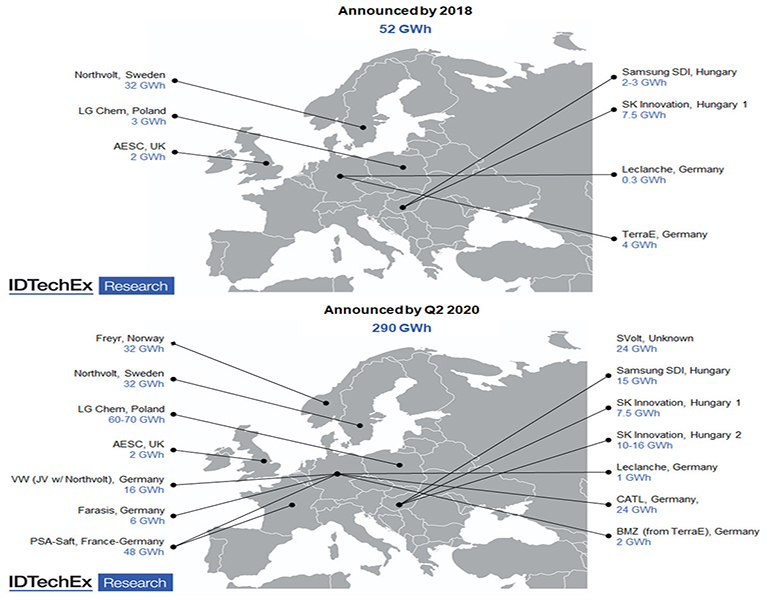

Automotive manufacturers the world over are now pledging to electrify their fleets. However, many traditional automotive manufacturers were slow to realize the potential of electric vehicles (EVs). Early growth of the EV and Li-ion markets were driven by China, where various subsidies and purchase incentives helped these industries to grow rapidly. China now controls much of the Li-ion market, from raw materials and chemicals production through to cell manufacturing and the US and Europe risk being left behind. As a result, significant investment has recently been poured into various aspects of the EV and Li-ion supply chain, especially in Europe. From 2018 to 2020, an extra 240 GWh of Li-ion production capacity has been announced to be located in Europe. One of many examples includes Volkswagens joint venture with Northvolt, to build a 16 GWh gigafactory in Germany to ensure supply for their production target of 1.5 mil EVs by 2025. Details of new and expanded Li-ion capacity in Europe are being announced regularly, as the need for electrified transport becomes clear and car manufacturers seek to avoid potentially costly fleet emissions targets. Comparing the announcements for Li-ion factories to be located in Europe before 2018 and in 2020, provides a stark example of how quickly investment has entered the Li-ion market in Europe and its desire to control some portion of production.

Despite this, the majority of capacity in 2020 is both located in China and owned by Chinese companies. Much of this comes from lesser known Chinese companies offering LCO and LFP batteries for consumer electronics and e-bike applications. These batteries are rarely qualified for electric cars, trucks or buses and electric vehicles, where performance requirements are most demanding, already make up the majority of demand. Indeed, Ford, Audi and Jaguar were all reported to have had issues with battery supply. IDTechEx estimate that production capacity outweighed demand by over 20%. However, the largest manufacturers, including the likes of LG Chem, Panasonic, Samsung and CATL (excluding Tesla and BYD), did not have the combined production capacity to meet Li-ion demand from electric vehicles. Compounding this is the fact that battery production plants will not be able to operate at 100%. This provides some perspective on the various reports of auto manufacturers struggling with battery supply. In the short-term, there may continue to be a deficit of Li-ion batteries suitable for electric vehicles. However, there has been considerable investment into new gigafactories and cell production capacity in China, North America and Europe, as noted previously. Given this investment and new cell production factories taking less than 2 years to build and come online (even less in China), cell production is unlikely to stifle electric vehicle growth past 2021-22.

However, for cell production to take place, the necessary supply of raw materials, such as lithium and cobalt, needs to be available. Bringing a new mine online can take 5 to 10 years but the relatively low lithium and cobalt spot prices currently being seen may not incentivise the necessary expansion in output, posing valid questions as to whether sufficient investment is taking place to meet mid-long-term battery demand. For example, IDTechEx estimate that the lithium contained in Li-ion batteries alone, from forecast demand in 2030, will be 2.3x higher than the global lithium mine output in 2019. Increases in cobalt, nickel, graphite and manganese demand of varying degrees will also be seen and given the relatively long timeframes to bring new mines online, investment needs to happen soon to ensure there is a sufficient supply of raw materials to enable the electrification of transport. While cell production capacity is unlikely to be responsible for supply constraints, raw materials may well be.

A new report from market intelligence firm, IDTechEx, provides a comprehensive overview of the Li-ion market with commentary and analysis on the bottlenecks that may hinder it. The report evaluates various aspects of the Li-ion market and technology and includes cell cost analyses, player strategies, technology developments and forecasts of Li-ion demand.

For a full analysis on markets, players, raw materials, technology developments and gigafactories from IDTechEx please visit www.IDTechEx.com/Lithium. Or for the full portfolio of energy storage research including the report “Li-ion Batteries 2020 – 2030” please visit www.IDTechEx.com/research/ES.