Li-Cycle Holdings Corp. (“Li-Cycle” or “the Company”) today announced that it has completed its previously announced business combination with Peridot Acquisition Corp. (“Peridot”).

The ticker symbols for the common stock and warrants of Peridot will change from “PDAC” and “PDAC.WS” to “LICY” and “LICY.WS”, respectively, and will begin trading on the New York Stock Exchange on August 11, 2021. The transaction was approved at an extraordinary general meeting of Peridot shareholders on August 5, 2021 and was unanimously approved by Peridot’s Board of Directors.

Ajay Kochhar, co-founder and Chief Executive Officer of Li-Cycle, said, “Consummation of our business combination with Peridot  marks a significant milestone for Li-Cycle. Peridot’s support of our mission to close the battery supply chain loop has been instrumental, and we look forward to our ongoing partnership with their team. We are well-positioned to benefit from macroeconomic tailwinds as we scale our efficient and proven commercial lithium-ion recycling technology to grow in lockstep with our customers. As the electric vehicle revolution continues to ramp up, we believe our technology will be critical for supporting the growth of e-mobility globally, while ensuring sustainability and resource efficiency.”

marks a significant milestone for Li-Cycle. Peridot’s support of our mission to close the battery supply chain loop has been instrumental, and we look forward to our ongoing partnership with their team. We are well-positioned to benefit from macroeconomic tailwinds as we scale our efficient and proven commercial lithium-ion recycling technology to grow in lockstep with our customers. As the electric vehicle revolution continues to ramp up, we believe our technology will be critical for supporting the growth of e-mobility globally, while ensuring sustainability and resource efficiency.”

Tim Johnston, co-founder and Executive Chairman of Li-Cycle, commented, “The transaction with Peridot has provided us with the funding to capitalize on significant growth opportunities, advance our breakthrough commercial technology, and build lithium-ion recycling facilities across the globe. Our solution transforms material treated as waste into considerable value via a truly fit-for-purpose pathway, providing the essential building blocks for batteries that are in critical demand. Sustainable lithium-ion battery recycling is imperative today and we believe that further execution of our vision will ultimately contribute to more affordable products for the end consumer.”

Alan Levande, the former Chairman and Chief Executive Officer of Peridot and now a Non-Executive Director of the Board of Directors of Li-Cycle, commented, “Li-Cycle’s innovative business model, exceptional management team, and proven, disruptive technology provides the company with a strong competitive moat that is poised to benefit from global electrification. Since announcing the transaction, the Li-Cycle team has demonstrated excellent stewardship – announcing foundational commercial agreements, bolstering the leadership team with strategic hires, strengthening the Company’s IP, and importantly, furthering progress on building out the Company’s Spoke and Hub model. We are excited to see its future successes amplified in the public markets.”

The business combination implies a pre-money equity valuation for Li-Cycle of $975 million and, when combined with the transaction proceeds, represents a combined company pro forma equity value of $1.55 billion. The transaction provided approximately $580 million in gross proceeds to the Company, including a $315 million fully committed, upsized common stock PIPE at $10.00 per share from investors that include Neuberger Berman Funds, Franklin Templeton and Mubadala Capital, as well as Peridot sponsor Carnelian Energy Capital, existing Li-Cycle investors including Moore Strategic Ventures, and global marketing and strategic off-take partner Traxys.

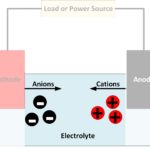

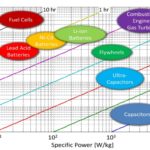

Li-Cycle is on a mission to leverage its innovative Spoke & Hub Technologies™ to provide a customer-centric, end-of-life solution for lithium-ion batteries, while creating a secondary supply of critical battery materials. Lithium-ion rechargeable batteries are increasingly powering our world in automotive, energy storage, consumer electronics, and other industrial and household applications. The world needs improved technology and supply chain innovations to better manage battery manufacturing waste and end-of-life batteries and to meet the rapidly growing demand for critical and scarce battery-grade raw materials through a closed-loop solution. For more information, visit https://li-cycle.com/.

Peridot was a blank check company formed for the purpose of entering into a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. Peridot’s sponsor was an affiliate of Carnelian Energy Capital Management, L.P., an investment firm that focuses on opportunities in the North American energy space in partnership with best-in-class management teams. For more information, please visit https://peridotspac.com/.

Li-Cycle’s existing senior management team continues to lead the now combined company, including Ajay Kochhar, Tim Johnston, Bruce MacInnis (Chief Financial Officer), Kunal Phalpher (Chief Commercial Officer), and Chris Biederman (Chief Technology Officer).

Li-Cycle’s Board of Directors is comprised of seven members, four of whom are “independent directors” as defined in the NYSE listing standards and applicable U.S. Securities and Exchange Commission (“SEC”) rules. The Board of Directors is led by Executive Chair Tim Johnston (Li-Cycle) and also includes Ajay Kochhar (Li-Cycle) and Alan Levande (Peridot).

Tell Us What You Think!